From 2019 onwards it is obligatory to establish whether foreign employees live in the Netherlands or abroad. Their home address has to be included in the payroll administration and a temporary address or postal address is not sufficient. Even if employees register with the municipality of their temporary address, this does not mean they will be designated as a resident of the Netherlands. The home address is important for the application of the correct wage tax tables.

Wage tax tables 2019 – payroll tax credit

Everyone who works in the Netherlands is entitled to tax credits which reduce their wage tax and increase their net wage. The payroll tax credit consists of the general tax credit and the employed person’s tax credit. An employee can have the payroll tax credit applied to a maximum of one employer. The tax credits have been included in the wage tax tables which employers have to use to determine the employee’s wage tax. The country the employee lives in is currently not important for the application of the payroll tax credit. As from 2019 the amount of the payroll tax credit will depend partly on the employee’s country of residence.

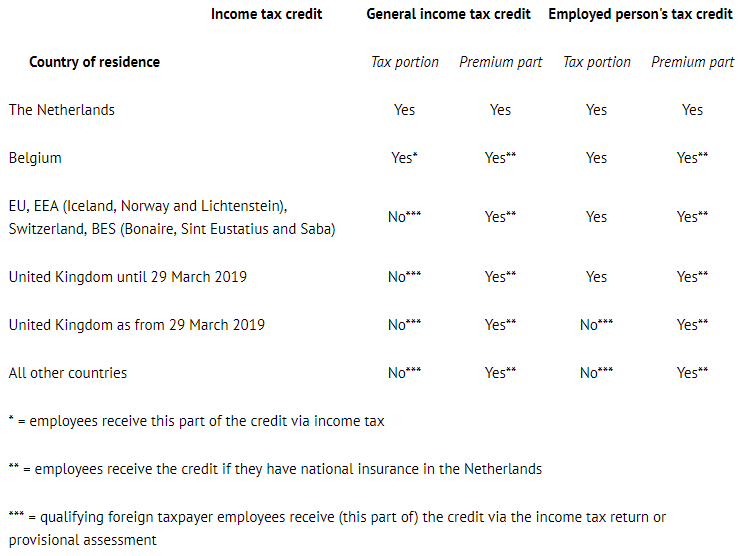

In order to apply the correct wage tax table, you have to know which country an employee is resident of. Only residents of the Netherlands are entitled to the full payroll tax credit. Non-residents are only entitled to (the premium) part of the payroll tax credit.

However, based on the tax treaty, residents of Belgium who work in the Netherlands are always entitled to the tax portion of the general tax credit. A provisional assessment can be used to assign the tax portion of the general tax credit to these employees during the year (irrespective of whether they are designated as qualifying foreign taxpayers).

The measure is being introduced to prevent the Tax and Customs Administration having to reclaim the tax credit applied in the payroll administration of numerous taxpayers who are resident abroad.

The table below shows which portion of the tax credits employees are entitled to. It is therefore immediately clear how important it is to know in which countries your employees actually live.

If you would like to know what the consequences are for the salary of your employee, we can make an extrapolation for you as soon as the wage tax tables for 2019 have been published.

Obligatory inclusion of foreign home address in payroll administration

In order to determine which wage tax table is applicable, you have to know which country an employee is resident of.

An employee who has his permanent place of residence or abode here is a resident of the Netherlands. He will therefore be entitled to the tax portion of the tax credits.

The question in the case of an employee who is living or staying in both the Netherlands and abroad is whether he is a resident of the Netherlands. An employee is usually a resident of the Netherlands if that is the location of his social and economic life. If, for example, the employee’s family lives abroad, his children attend school there and he has bank accounts there, he will generally not be a resident of the Netherlands. He will then usually not be entitled to the tax portion of the tax credits.

In the case of an employee without a family the intention can also be important. In other words if he intends to live here, he will usually be a resident of the Netherlands. If he only intends to stay here for a short time, he will not be a resident of the Netherlands.

With regard to employees who are not residents of the Netherlands, you are obliged, from 2019 onwards, to include their foreign home address in the payroll administration. If you do not know their foreign home address, you will have to apply the anonymous rate. The anonymous rate means that a tax rate of 52% is applicable to the entire wage!

Make sure that your records are up-to-date and that you inform us of your employees’ foreign addresses. We do not know where your employees live and are therefore completely dependent on the details you submit!

TIP: In order to ensure that your employees provide the correct address information, we recommend that you have them sign a statement. Employees can use this statement to indicate which country they are a tax resident of, along with the corresponding home address. This statement can also state that the employee is obliged to inform you of any changes to their home address. If you would like more information about this statement, or its format, please do not hesitate to contact us.

You can also ask your employee to request a (fiscal) statement of domicile from the tax office (of his country of residence) that he is covered by.

Informing employees

It is important that your employees are aware of the changes which are going to take place in 2019. The net wage of employees who live abroad will go down because lower tax credits will be taken into account when using the wage tax tables.

You can point out to your employees that the correct amounts of the tax credit will be taken into account when submitting an income tax return or applying for a provisional assessment.

The Tax and Customs Administration recently also informed employees that it knows to be resident abroad about the changes.

In order to use the correct wage tax table, you have to know which country your employee is resident of. You can access a flow chart here which can be used to determine whether your employee is a resident of the Netherlands or not.